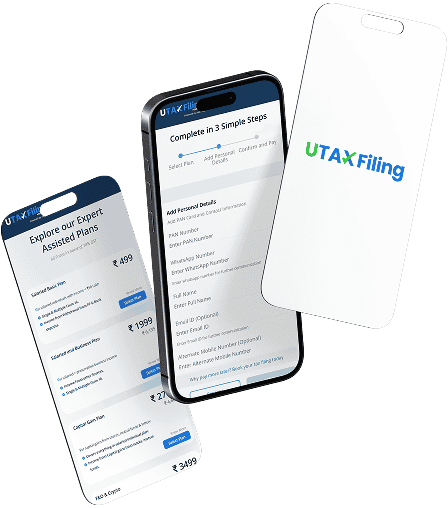

Explore our Expert Assisted Plans

All Prices inclusive of 18% GST

Salaried Basic Plan

₹499

For salaried individuals with income < ₹50 Lakh

Single & Multiple Form 16.

Income from Withdrawal from PF & Bank deposits.

Salary Income is less than 50 Lakh.

Salaried and Business Plan

₹1,999

₹6,135

For salaried + presumptive business income

Income From other Sources.

Single & Multiple Form 16.

Income from Withdrawal from PF & Bank deposits.

Capital Gain Plan

₹2,799

₹4,685

For capital gains from shares, mutual funds & lottery

Covers everything in salaried individual plan.

Income from Capital gains from stocks, mutual funds.

Income from Capital gains from selling of house property.

F&O & Crypto

₹3,499

₹6,500

For trading and crypto investors

Covers everything in salaried individual plan.

Income from Capital gains from crypto holdings.

Income from Capital gains (includes intraday, leverage).

Why We're Your Best Choice

Start your filing at 499/-

Start your filing at 499/-

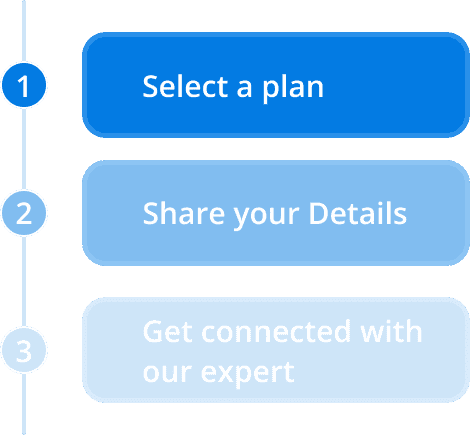

File your taxes in just 3 easy steps

Hear From Our Happy Tax Payers

About Us

At UTAX Filing, we simplify the most stressful part of your financial year – Income Tax Return filing.

With 13+ years of proven expertise in taxation and finance, we have successfully helped thousands of salaried professionals, freelancers, and business owners file their ITRs with ease and accuracy.

Our team of experts ensures:

- Correct regime selection for maximum refund

- Error-free filing to avoid notices and penalties

- Quick turnaround – ITR filed within 24 hours

We believe tax filing should be simple, secure, and stress-free. With UTAX, you get a trusted partner who takes care of your taxes while you focus on what matters most.

Stay Updated With Our Tax Blogs

5.5k

2.9k

3 min read

Smart Tips To Get A Bigger ITR Return And Earn More Interest

If you serve in the defence forces or are part of a defence family, your financial responsibilities may differ from those of civilians. You move frequently, claim special defence allowances, and may have investments tied to government savings schemes.

Read More

8.7k

1.3k

3 min read

9 Key Changes in ITR-1 to ITR-4 for FY 2024-25 (AY 2025-26)

Income tax filing in India is continuously evolving to ensure simplicity, accuracy, and compliance with updated financial laws. For the Assessment Year (AY) 2025–26, which corresponds to the Financial Year (FY) 2024–25, the Income Tax Department has rolled out several key changes across the ITR-1 to ITR-4 forms.

Read More

2.5k

100

2 min read

NPS vs PPF vs DSOPF: Which Retirement Plan Is Best for Defence Personnel?

If you are a serving defence officer or a retired veteran, planning for retirement is not just about securing your future—its about doing it wisely.

Read More

in Pune, India

in Pune, India